what is an example of an ad valorem tax

7160The implementing rules and regulations of R. Real Property Tax is the tax on real property imposed by the Local Government Unit LGU.

An ad valorem tax is commonly levied on both real and personal property.

. Let us look at an example of competitive advantage Tesla Incorporation. Ad-Valorem tax is levied on both real property and personal property. Most Ad valorem taxes are levied based on the value of the item purchased.

Its also called an ad valorem tax. Tesla is a company that produces luxury cars and high-tech technology. 7160 can be found here.

It is a local tax that reflects local budget priorities. Is a full service ad-valorem tax assessing and collection service for political units of government authorized to assess and collect in the fields of property taxes and assessments. For example if youre filing married and your tax deductions total more than 25100 you should take an itemized deduction.

Fair Market Value x 40 - Exemptions Taxable Value. Using the ad valorem values and allowing for exemptions the tax roll is completed by the Property Appraiser. The ad valorem tax more commonly called property tax is the primary source of revenue for local governments in Georgia.

To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. For example lets say you have a four-bedroom home with a one-car garage and your home is assessed at 250000. An example of an improvement is a garage added to a single family home or a road built on land.

Excise Duty on Petrol. A special assessment is not an ad valorem property tax. For a 2000 annual property tax bill for example you would pay about 167 a.

Serving Southeast Texas since 1970 Equi-Tax Inc. Sales taxes tariffs property taxes inheritance taxes and value-added taxes are different types of ad valorem tax. Applying the general rate as at March 2021.

Please note that exemptions from property taxation are exemption from ad valorem taxation. 122505 - 17835 section 64D credit. Property taxes are an ad valorem tax so the tax is based on the value of the property.

Another example of a tax with few deadweight costs is a lump sum tax such as a poll tax head tax which is paid by all adults. The assessed value is the standard basis for local real property taxes although some place caps maximums on the percentage of value as under Proposition 13. Latin for based on value which applies to property taxes based on a percentage of the countys assessment of the propertys value.

Our mission is to provide consistently outstanding customer service by making. From this information the Tax Collector prints and mails the tax notice to the owners last recorded address as it appears on the tax roll. Then the dutytaxes calculation is.

They do not apply to direct levies or special taxes. If the CIF value of the imported goods is USD 1000 Import Duty is 5 and the Sales Tax is 12. Taxable Value x Millage Rate Tax Due.

If you look at all the aspects of their business it can be said that they have no direct competitors based on the industry they operate in and based on the productservices they provide. Firstly it is to be determined which input costs are indirect by nature for the manufacturing of a product or service deliveryNext add up all these costs together to arrive at the total manufacturing overhead. Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point.

Homeowners who meet the following requirements are eligible. The certified non-ad valorem assessments roll is then merged with the certified ad valorem roll. Adjective imposed at a rate percent of value compare specific 5b.

Also it is payable irrespective of the import value. Ad valorem duty on 2500000 122505. The Tax Collector collects all ad valorem taxes levied in Polk County.

For the sake of simplicity this example uses a millage of 25 per thousand dollars of Taxable Value and excludes non-ad valorem taxes. Real property includes land buildings and other structures and any improvements to the property. The Tax Commissioner is responsible for billing the property owner of record as of January 1.

This tax is used to fund general or day-to-day government operations. A property tax is based upon a propertys market value. The RPT for any year shall accrue on the first day of January and from that date it shall constitute a lien on.

12 18 and 28 percent. The Tax Collector also collects non-ad valorem assessments which are also made by taxing authorities on real property to provide essential services such as fire protection garbage collection lighting etc To view the annual millage rates and assessment provided to the. The property tax most citizens are aware of is known as an ad valorem tax.

Welcome to our online services. Note that you are still able to import some goods to the Philippines free of. Ad Valorem Tax depends on the quality or content of the products.

The amount of ad valorem duty at the general rate is to be reduced by the amount of duty paid by Purchaser B on the earlier nomination. The Long-Term Resident Senior Exemption is an additional homestead exemption that provides a local option for county and city governments excluding school board to eliminate their ad valorem portion of the tax bill to qualifying low-income seniors. Example GST in India has 5 tax rate slabs- 0 5.

Property tax is an ad valorem tax assessed on real estate by a local. Ad valorem tax is calculated using the following formula. The executed Exercise Notice is the instrument liable to ad valorem transfer duty.

The legal basis is Title II of the Local Government Code LGC Republic Act RA no. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. An ad valorem tax is one where the tax base is the value of a good service or property.

Specific tax is levied based on the volume of the item purchased. Here is an example calculation for a home with a fair market value of 100000. The tax is usually expressed in specific sums.

Ad valorem means according to value The county Board of Commissioners sets the millage rate for county taxes the county Board of Education sets the millage rate for county school taxes and the city authorities determine. Ad Valorem is Latin for according to value and is thought to be a fair basis for collecting taxes because the tax is proportional to your ability to pay and the benefits you gain from the services the county provides. For example annual tax bills may include other items such as special assessments special taxes direct levies delinquent county utility billings weed and hazard abatement charges and Mello-Roos Bonds.

Your property taxes are calculated by dividing the Taxable Value by 1000 multiplying by the millage and adding any non-ad valorem taxes such as waste special taxing districts road fire etc. Next calculate all the administrative costs and general costs that cant be directly allocated to the manufacturing of the product or service delivery. The tax is usually expressed in percentage.

It Is That Time Of The Year This Is One Of Many Tips For Tax Season Did You Know For Example That Like Other Home In 2022 Mortgage Interest Homeowner Property Tax

Tax Consulting Services Flyer Poster Template Tax Consulting Income Tax Return Tax Return

A Flow Chart For How To Appeal Property Taxes Some Of The Details Might Differ In Your Area But Many Details Will App Property Tax Understanding How To Apply

Not Really Sure Which Tax Deductions Are Available For You Read Over Thi Real Estate Investing Rental Property Commercial Rental Property Investment Property

Empowered By Them Taxes Teaching Life Skills Life Skills Classroom Teaching Life

Here Is A Worksheet On Taxes We Live In California So I Used The Taxes That Apply To Us I Also Used A Minimum Amount Of Income Tax Income Tax

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator With Questi Supportive Property Tax Tax Exemption

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Property Investment Property Management

Cs Executive Introduction To Direct Tax Income Tax Property Tax Online Taxes Income Tax Tax

A Sample Property Tax Appeal Letter Tips For Successful Filing Property Tax Tax Software Number Properties

Rental Property Spreadsheet Template For 25 Properties Business Property Management Property Management Marketing Rental Property Management

Pin By Diarmuid O On Fun Economics Lessons Learn Economics Economics Notes

Rental Cash Flow Analysis Real Estate Investing Rental Property Rental Property Investment Real Estate Investing

Here Is A Worksheet On Taxes We Live In California So I Used The Taxes That Apply To Us I Also Used A Minimum Amount Of Income Tax Income Tax

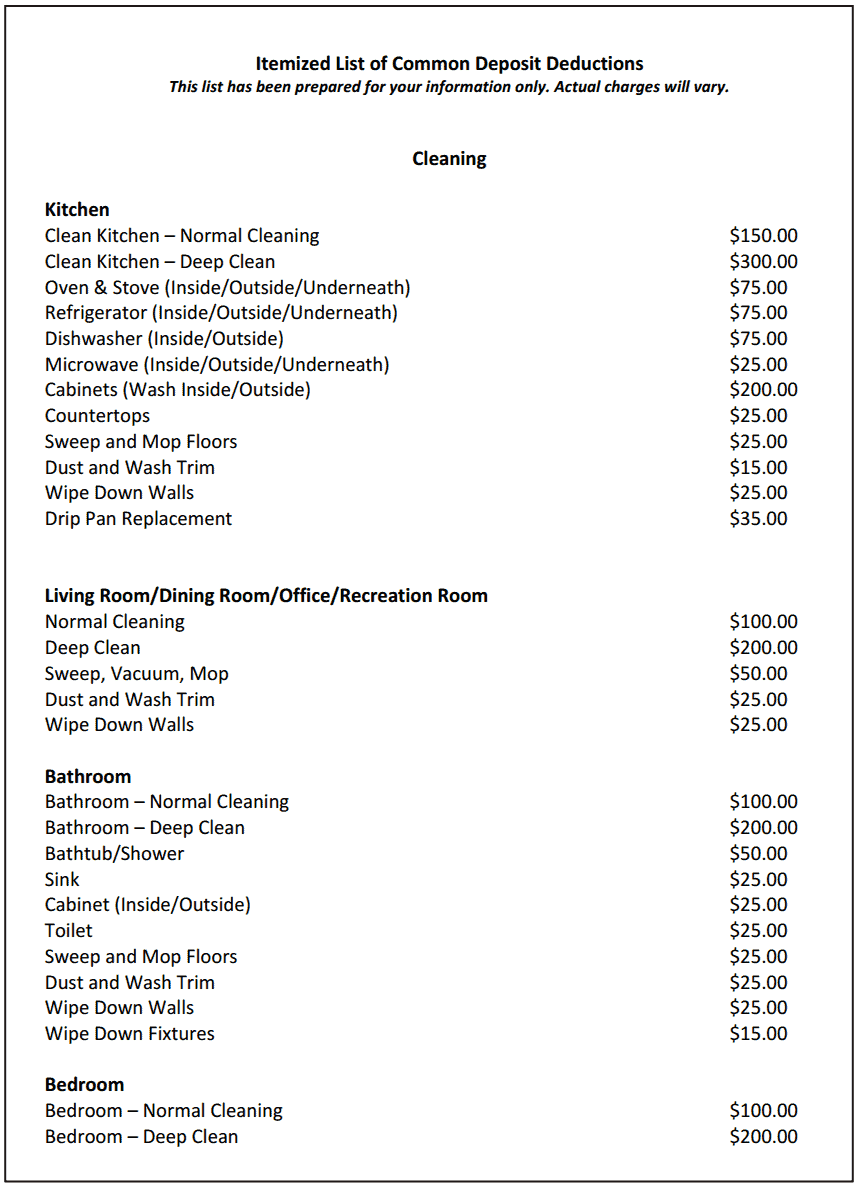

The Landlord S Itemized List Of Common Tenant Deposit Deductions Being A Landlord Rental Property Rental Property Management

Landlord Checklist Template Being A Landlord House Flipping Business Rental Property Management

Personal Financial Literacy Identifying Taxes Teks 5 10a

Pin By Sh Investments On Random Mortgage Online Mortgage Real Estate Information